Global share markets had a volatile week reflecting the problems in banks but with banking system backstops and hopes of less central bank rate hikes providing some support. US shares actually rose 1.4% for the week having fallen further than other markets the week before in an initial response to the banking problems. But Eurozone shares fell 4.2%, Japanese shares fell 2.9% and Chinese lost 0.2%. Australian shares fell 2.1% playing catchup to the falls in US shares and as global worries weighed on energy & material stocks via lower oil and metal prices with sharp falls also in IT, retailers and financials. Bond yields fell again in response to safe haven demand & a fall in expectations for short term interest rates. Gold and iron ore prices rose but oil and metal prices fell on growth worries. The $A rose as expectations that the Fed is near the top on rates weighed on the $US.

First the bad news. While bank failures so far do not look anything like a re-run of the GFC, they are still a reason for concern with the problems at Credit Suisse and First Republic highlighting “contagion” risks. Headlines screaming that the US has seen the biggest bank collapse (with Silicon Valley Bank) since 2008 naturally engender fears of a re-run of the GFC. However, the situation today is radically different to 2008 when US bank failures reflected systemic issues in their assets where lending to US sub-prime and low doc home borrowers had ballooned, were packaged into heavily geared securities and sold globally causing big problems as the borrowers defaulted en masse. This time around the problems in US banks have reflected poorly diversified deposit bases (tech and some crypto in the case of SVB) and large scale withdrawals as depositors needed the cash forcing the banks to sell bonds at a loss. Poorly diversified deposits and assets (with SVB’s security holding at 57% of its assets being an outlier amongst US banks). But not the stuff of the GFC. Nevertheless, its still a sign of rising financial stress and the refocus on already weak Credit Suisse followed by issues at First Republic Bank (resulting in big US banks moving to deposit $US30bn into it) show how it can spread globally as investors speculate who might be next. Record bank borrowings of $303bn at the Fed’s discount window (presumably by banks not wanting to sell their bond holdings at a loss in order to meet deposit withdrawals) highlight the scale of stress in the US banking system. Unrealised losses on banks bond holdings are also likely to be an issue outside the US.

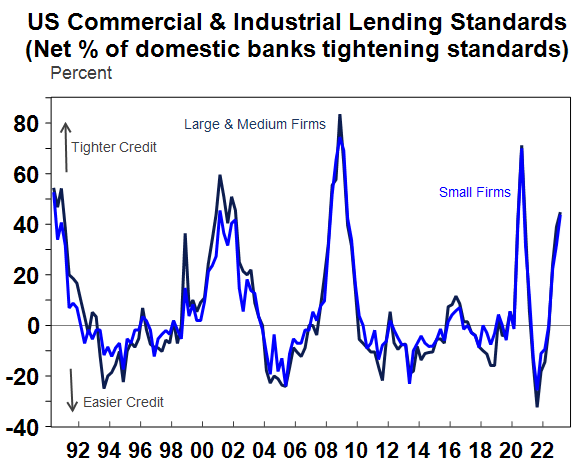

Whether it’s the sort of crisis that in the past has ended and then reversed Fed monetary tightening is still unclear. But it could be. So far, the US authorities have sought to protect uninsured depositors (to prevent runs on other banks and large scale economic damage) and the Fed has pledged cheap liquidity for banks so they don’t have to sell securities at a loss. And the Swiss National Bank has provided $US54bn in liquidity support for Credit Suisse. Whether this is enough remains to be seen. But central banks will also need to move more cautiously in terms of interest rates as we know from history that financial crisis lead to tighter bank lending conditions – they were already tightening prior to this according to the Fed’s bank survey (next chart) – and this will adversely affect economic growth which adds to the already high risk of recession in the US and Europe. And weaker global growth will in turn impact Australia even though our banks are less vulnerable to the issues impacting banks in the US and Europe – adding to the risk of recession here flowing from significant rate hikes.

Source: US Federal Reserve, Macrobond, AMP

The good news – financial crisis put a brake on central bank tightening. A natural concern is that with high inflation central banks have less flexibility to respond with lower rates. This may be true in the very short term, but history shows that a widespread financial crisis by hitting economic activity will also curtail inflation. So, the initial response by central banks may be to see deposit protection and liquidity backstops as dealing with financial stability risks, such that they can continue raising rates to deal with inflation albeit a bit more slowly. But if banking crises get worse then they will have to consider cutting interest rates. Looking at the major central banks:

- The ECB tightened as it flagged last month by 0.5% citing high inflation. But its guidance on future moves was far less hawkish as it acknowledged “elevated uncertainty”, revised down its inflation forecasts, stressed that future moves would take into account “economic and financial data” and noted that it stands ready to “provide liquidity support” if needed to the financial system. So gone is the clear guidance of further rate hikes and future moves will be influenced by what happens in the financial system. It probably still has more to do on rates but is now nearer the top with the money market only pricing in another 0.25% of ECB hikes.

- The Fed will probably continue to hike in the week ahead – as jobs and retail sales data have been mixed but underlying inflation came in a bit stronger than expected – but partly due to the banking problems its likely to be +0.25% and not the +0.5% Powell flagged as possible. However, if banking problems are continuing to flare up into the meeting then the Fed will likely pause. The US money market is now only pricing in another 0.4% of Fed hikes.

- The Bank of England has been looking for a reason to pause and the banking problems provide a reason to do so.

- We continue to see the RBA pausing in April and global banking stresses have added to the case. In terms of Governor Lowe’s check list: jobs data have arguably come in on the strong side but probably no more than expected; business conditions in the NAB survey were still solid but slowing; and we are still waiting for data on retail sales (28 March) and inflation (29 March). However, the global banking crisis cannot be ignored by the RBA. Sure, Australian banks are in good shape but they are vulnerable to the increasing risk of global recession and the flow on of this to Australia (via reduced export demand and a hit to confidence) and the Australian property market. The money market is now pricing in no chance of a rate hike next month (which seems a bit too extreme) and that rates have effectively peaked (which is in line with our own view).

So far, the share market sell-off in response to the banking crisis, while volatile, has been relatively mild suggesting investors are giving more weight to the view that the crisis will help cool inflation – by slowing growth – and so interest rates won’t have to rise as much as previously thought. US tech stocks and crypto currencies appear to be celebrating a return to easy money!

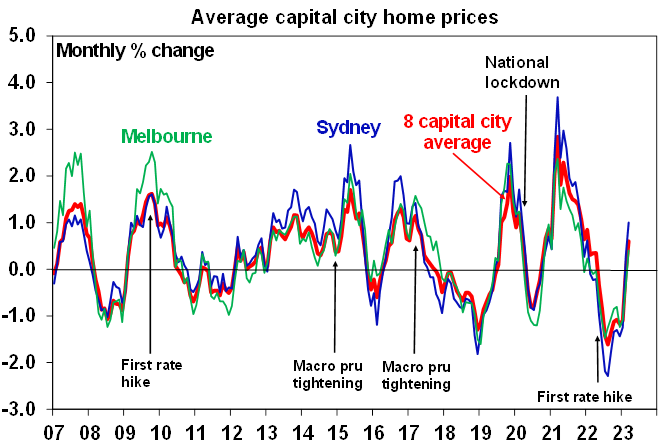

Of course, all this stuff about global banks is very interesting but I suspect more Australians might be wondering if home prices have bottomed!? CoreLogic data shows that the stabilisation in average prices that began in February has morphed into price gains across several cities so far in March with Sydney prices tracking up 1% at a monthly rate so far this month and five capitals city average prices tracking up 0.6%. So are property prices doing it again? – falling less than expected and then rising more than expected. Maybe. There are a bunch of positives for the property market: the rapid return of immigrants and foreign students; very tight rental markets; a 9% plunge in prices which is the biggest fall since 1980 on CoreLogic data which may have attracted bargain hunters not so impacted by the surge in interest rates; very low levels of listings; and maybe signs that the RBA is close to the top on rates. Against this: interest rate hikes are still feeding through for existing borrowers and the fixed rate mortgage cliff is ahead of us all of which could boost distressed selling; while we think rates are at or close to peaking numerous economists still see the cash rate rising above 4%; the hit to buying capacity (of around 25% for a buyer with a 20% deposit and average full time earnings) remains even if rates have stopped rising; the Australian economy is likely to slow sharply in the year ahead resulting in rising unemployment; and in past property cycles prices have only bottomed once interest rates started falling. Our base case remains that the current bounce will be short lived as demand from bargain hunters runs its course, the impact of higher interest rates reasserts itself and supply increases in response to distressed selling. However, I must admit to seeing the current environment as very hard to read and so admit there is a chance that prices have bottomed particularly if rates have peaked and if the Australian economy has a soft landing.

Source: CoreLogic, AMP

Productivity isn’t everything but it nearly is. The latest Australian productivity review by the Productivity Commission highlights the decline in productivity growth in recent years with the Treasurer reportedly keen to lift productivity growth. This is good news and hopefully its serious. Growth in productivity is key to sustained growth in living standards. Australia needs a new round of productivity enhancing economic reforms in terms of the tax system (sounds like a broken record there), competition, the non-market services sector, industrial relations, education and training and energy generation. But the problem is many of the reforms required are not politically fashionable these days.

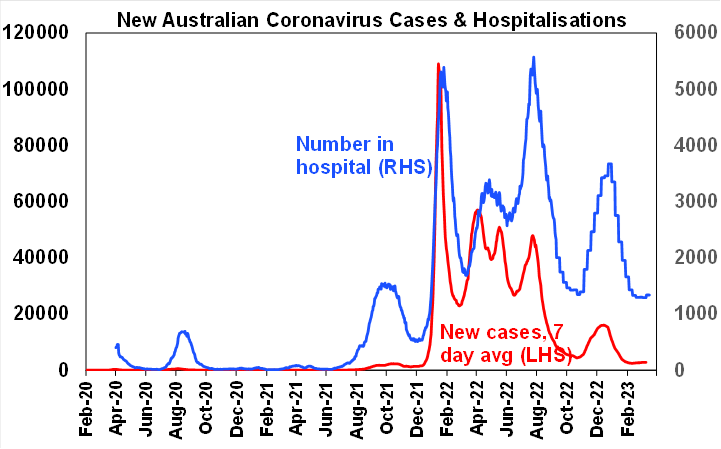

Coronavirus update

New global Covid cases and deaths continue to trend down. New cases & hospitalisations in Australia are rising with NSW cases up four weeks in a row – but levels are still low.

Source: covidlive.com, AMP

Economic activity trackers

Our Economic Activity Trackers fell in Australia, the US & even Europe (only slightly) over the last week, consistent with slowing but not collapsing growth.

Levels are not really comparable across countries. Based on weekly data for eg job ads, restaurant bookings, confidence, credit & debit card transactions and hotel bookings. Source: AMP

Major global economic events and implications

US economic data releases over the past week were mostly soft. Retail sales slowed significantly from their January spurt, industrial production was flat, the US Leading Index fell again continuing to point to recession, manufacturing conditions in the New York and Philadelphia regions remained very weak and small business optimism remained low. Against this the NAHB home builders index rose slightly (but still remains weak), housing starts rose 10% reflecting a rise in units and jobless claims fell back again.

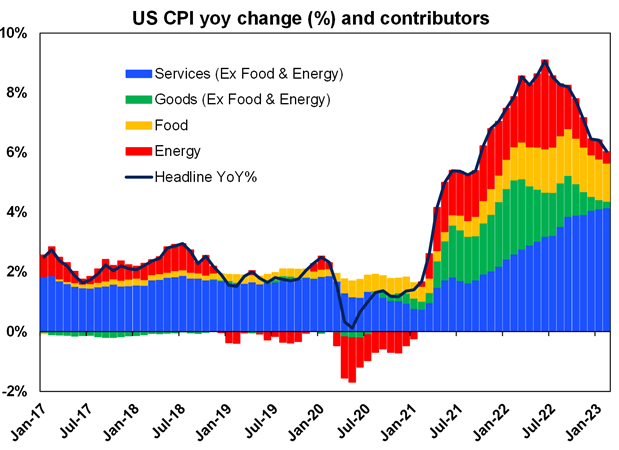

While US core CPI inflation came in slightly stronger than expected in February thanks to services and rental inflation, annual inflation is still slowing, goods price inflation has slowed to a crawl, producer price inflation fell more than expected and the various business surveys showed an easing in cost and price pressures with low backlogs and delivery times which are consistent with lower inflation ahead. The University of Michigan survey also showed a further fall in inflation expectations.

Source: Bloomberg, AMP

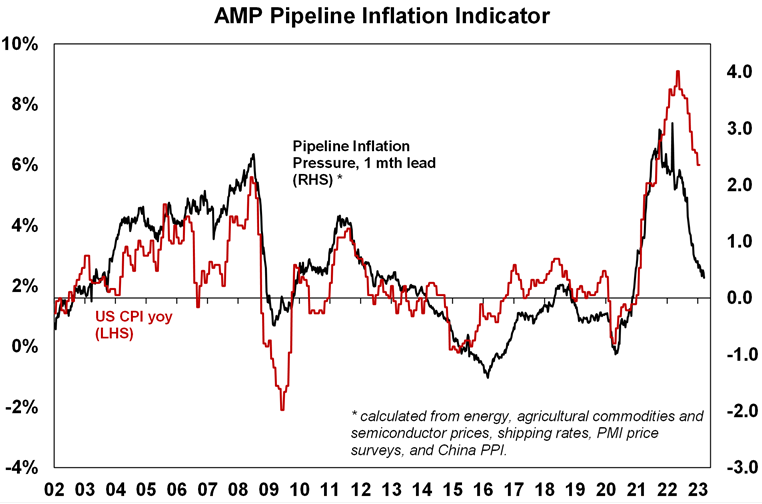

Our US Pipeline Inflation Indicator continues to point to lower US inflation ahead.

Source: Bloomberg, AMP

In China the PBOC provided additional monetary stimulus by cutting bank’s required reserve ratios by 0.25% and economic activity rebounded pretty much as expected in January/February on the back of reopening with retail sales growth rebounding to 3.5%yoy (from -1.8%yoy in December) and industrial production accelerating to 2.4%yoy (from 1.3%yoy). Chinese property sales and home prices have also started to recover. Expect further improvement in ahead as pent-up demand pushes Chinese growth to around 6% from 3% last year.

The New Zealand economy contracted 0.6% in the December quarter with flat consumption and falling housing and business investment. With the RBNZ’s cash rate already at 4.75%, the economy contracting faster than it expected and given the risks around global banks we think the RBNZ should and possibly will hold rates unchanged at its April meeting.

Australian economic events and implications

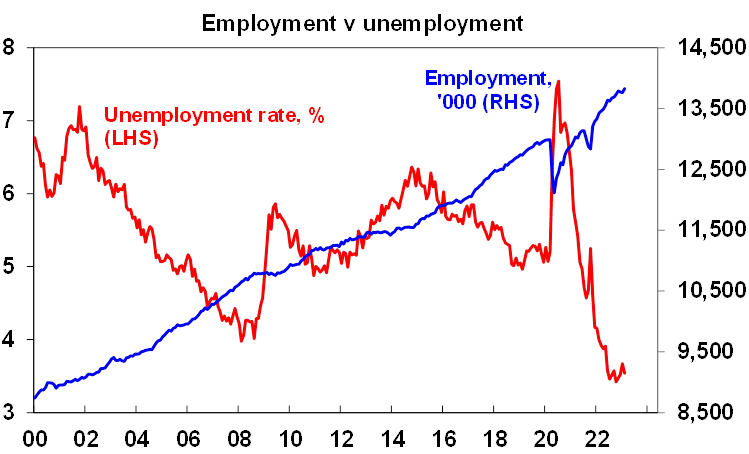

The Australian jobs market still looks like its starting to cool. Employment rebounded in February and unemployment fell back to 3.5% confirming that seasonal adjustment problems had played a role over the Christmas/New Year in depressing measured employment. Clearly the jobs market remains very tight which will keep the RBA worried about a wages breakout. However, the jobs rebound had already been anticipated by the RBA and there are increasing signs that the jobs market is cooling: the 3 months average rate of jobs growth has slowed to a crawl; job openings appear to be softening; and the participation rate and the proportion of the population in employment appear to have peaked. What’s more the Melbourne Institute’s consumer survey points to only moderate wages growth.

Source: ABS, AMP

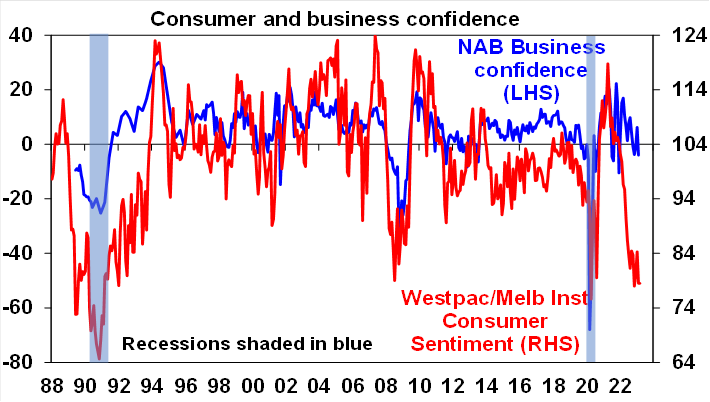

Meanwhile confidence readings were weak with consumer confidence remaining unchanged at recessionary levels in the March Westpac/MI survey and business confidence falling in the NAB survey. While business conditions remain solid, depressed consumer confidence points to weak demand & conditions ahead.

Source: Westpac/MI, NAB, AMP

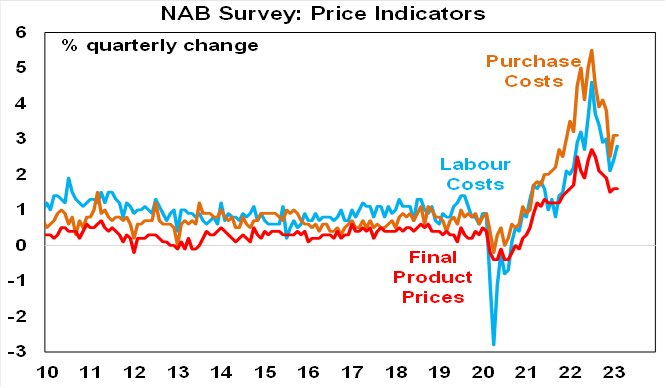

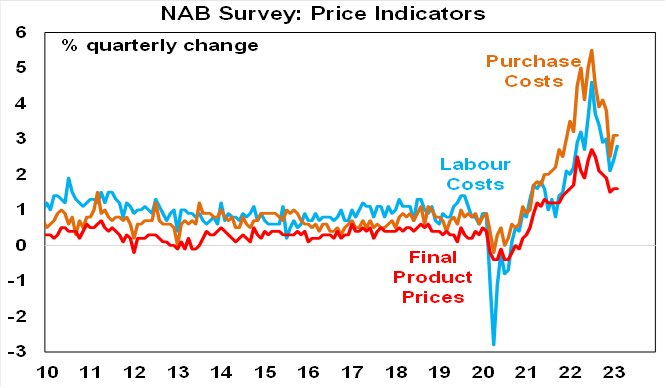

Unfortunately, the February NAB survey showed flat purchase and final price indicators and a rise in labour costs – but at least all remain well down from their highs.

Source: Westpac/MI, NAB, AMP

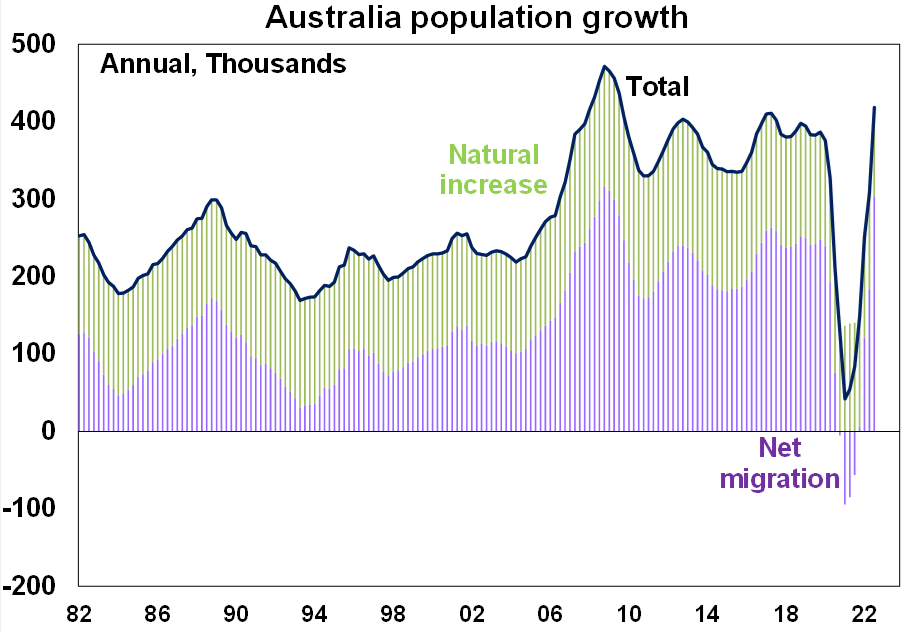

Australian population growth rebounded to 1.6%yoy in the September quarter thanks to a sharp rebound in immigration with net long term and permanent arrivals pointing to further strength ahead. Queensland population growth at 2.2%yoy is leading the charge thanks to very strong interstate migration.

Source: ABS, AMP

Source: ABS, AMP

What to watch over the next week?

In the US, while we think a Fed pause at its FOMC meeting on Wednesday would make sense in response to banking stress, its more likely to hike the Fed Funds rate by another 0.25% taking it to a range of 4.75-5%. It probably sees deposit protection and its Term Funding Facility as enough for now to manage financial stability risks leaving it free to continue with rate hikes to deal with inflation. However, while Fed Chair Powell had flagged a possible reacceleration in rate hikes to +0.5%, recent data for job openings, employment, inflation and retail sales has been sufficiently mixed along with the worries about bank stresses to see the Fed stick to +0.25%. And on the other hand, absent a further flare up in bank problems the Fed likely sees recent data as not being soft enough hold. However, while the bank stresses are likely to constrain its hawkishness, the peak dot of Fed officials rate hikes is likely to move up again to 5.25-5.5% reflecting recent sticky inflation and its commentary is likely to still lean hawkish.

On the US data front expect a rise in existing home sales (Tuesday) but a fall in new home sales (Thursday) and soft underlying durable goods orders (Friday). Business conditions PMIs for March will also be released on Friday.

Canadian inflation (Tuesday) is likely to slow further from 5.9%yoy.

Eurozone business condition PMIs for March (Friday) will be watched to see if recent strength is maintained.

The Bank of England (Thursday) is expected by most economists to increase interest rates by another 0.25% to 4.25%, but we expect that it will hold given banking issues. Inflation (Wednesday) is also likely to edge down a bit further to 9.9%yoy from 10.1%.

Japanese inflation (Friday) is likely to fall back to 3.3%yoy due to utility subsidies with core inflation rising to just 2%yoy. Business conditions PMIs will also be released Friday.

In Australia, the minutes from the last RBA meeting (Tuesday) will likely confirm the RBA’s somewhat less hawkish stance compared to February but will be watched to see just how open it is to a pause in rate hikes next month. Business conditions PMIs for March (Friday) will also be watched to see if the recent improvement is maintained.

Outlook for investment markets

The year ahead is likely to see easing inflation pressures, central banks moving to get off the brakes and economic growth weakening but stronger than feared. This along with improved valuations should make for better returns than in 2022. But as we are now seeing there will be bumps on the way – particularly regarding interest rates, recession risks, geopolitical risks and raising the US debt ceiling in the September quarter.

Global shares are expected to return around 7% this year. The post mid-term election year normally results in above average gains in US shares, but US shares are likely to be a relative underperformer compared to non-US shares reflecting still higher price to earnings multiples versus non-US shares. The $US is also likely to weaken which should benefit emerging and Asian shares.

Australian shares are likely to outperform again, helped by stronger economic growth than in other developed countries and stronger growth in China supporting commodity prices and as investors continue to like the grossed-up dividend yield of around 5.5%.

Bonds are likely to provide returns a bit above running yields, as inflation slows and central banks become less hawkish.

Unlisted commercial property and infrastructure are expected to see slower returns, reflecting the lagged impact of weaker share markets and last year’s rise in bond yields (on valuations).

Australian home prices are likely to fall another 8% or so as rate hikes continue to impact, resulting in a top to bottom fall of 15-20%, but with prices expected to bottom around the September quarter, ahead of gains late in the year as the RBA moves toward rate cuts.

Cash and bank deposits are expected to provide returns of around 3.25%, reflecting the back up in interest rates through 2022.

A rising trend in the $A is likely over the next 12 months, reflecting a downtrend in the overvalued $US, the Fed moving to cut rates and solid commodity prices helped by stronger Chinese growth.

What you need to know

While every care has been taken in the preparation of this article, neither National Mutual Funds Management Ltd (ABN 32 006 787 720, AFSL 234652) (NMFM), AMP Limited ABN 49 079 354 519 nor any other member of the AMP Group (AMP) makes any representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided and must not be provided to any other person or entity without the express written consent AMP. This article is not intended for distribution or use in any jurisdiction where it would be contrary to applicable laws, regulations or directives and does not constitute a recommendation, offer, solicitation or invitation to invest.

The information on this page was current on the date the page was published. For up-to-date information, we refer you to the relevant product disclosure statement, target market determination and product updates available at amp.com.au.